I’ve talked about financial stuff a little bit recently - after Mr E’s redundancy, which really shook us up, we’ve been having a good, long look at our finances, and thinking harder about what we do with our money.

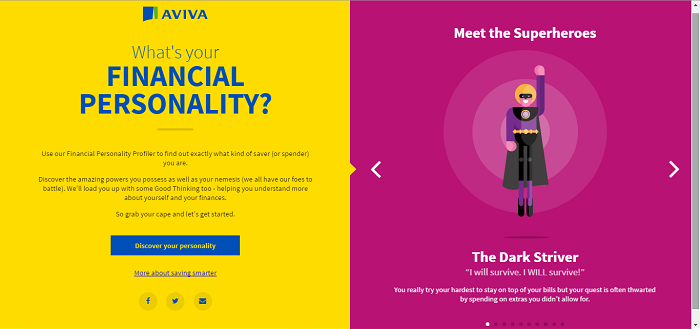

So when Aviva asked me to work with them to try their Financial Personality Profiler tool, designed to get us all saving smarter, I was really interested to see how I fared. After asking a few questions, the profiler allocates you one of 10 personality types, each with different spending/saving traits (a bit like a superhero), so you can determine whether you’re Captain Savvy (financially informed, but prone to self indulgence), or the Super-Stretcher (financially astute, but likely to overspend on their family).

Aviva’s financial personality profiler tool

Once you’ve worked out your financial personality, there’s some great advice for battling your financial nemesis.

You might think it’s a gimmick, but I found that as you work through the questions, you really have to stop and think about whether you’re being completely honest - are you influenced by others (the answer is yes from me)? Are you prone to splash out and ‘treat yourself’? There are some very clever questioning techniques in there too - whether you’re the kind of person that has an addictive personality, even your box set viewing habits! But it’s all designed to get to know you and work out exactly what sort of relationship you have with your cash.

I have to say, having worked through the questions, my result was spot on: I’m a ‘time dueller’ - always rushing, always overwhelmed, never enough time and generally juggling multiple tasks at once. Things get added to my to do list, but if they’re not interesting, they’ll generally get ignored until the very last minute!

The advice I got was good, as well. I need to worry less about the small spending decisions I make (like driving to the next petrol station to save a couple of pence on my petrol fill up) and concentrate on some of the bigger issues. And honestly, I know exactly what my weaknesses are: popping out when I’ve had a busy week and splurging, even if sometimes I really know I shouldn’t. It’s made me think that I need to try and find small treats to reward myself after a busy week and resist the urge to shop online for things I don’t really need but that make me feel good.

SO interesting.

Do give it a go - I guarantee it will make you really think about your own financial personality. Let me know how you get on! Watch out for the second instalment next week, when I’ll be talking about savings hacks and giving you my own tips on how to #savesmarter!

This post is sponsored by Aviva. Click here for more information on Aviva’s #SaveSmarter campaign.